November 2025 ISM PMI Report: Insights into U.S. Manufacturing Trends

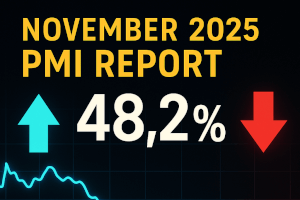

November 2025 ISM PMI Report 48.2% What the Latest Data Reveals About U.S. Manufacturing

The Institute for Supply Management (ISM) released the November 2025 PMI Report, showing a PMI reading of 48.2%, down from October’s 48.7%. A reading below 50% signals contraction, marking the ninth consecutive month of decline in U.S. manufacturing.

Understanding the November PMI Reading

The PMI is a composite index of five components: New Orders, Production, Employment, Supplier Deliveries, and Inventories, which together reflect the real-time conditions within American factories.

In November, four out of five categories remained in contraction, with Production as the only expanding indicator, suggesting a persistent manufacturing slowdown.

Key Sub-Index Results for November 2025

| Sub-Index | November 2025 | Change vs October | Interpretation |

|---|---|---|---|

| New Orders | 47.4% | -2.0 pts | Contraction deepening; weak pipeline for Q1 2026 |

| Production | 51.4% | +3.2 pts | Expansion; the month’s only positive indicator |

| Employment | 44.0% | -2.0 pts | Significant job reductions and hiring freezes |

| Inventories | 48.9% | +3.1 pts | Still contracting, but at a slower pace |

| Supplier Deliveries | 49.3% | -4.9 pts | Faster deliveries; typically reflects slack demand |

What These Numbers Show

- Demand Remains the Core Issue: The decline in New Orders to 47.4% suggests customers remain cautious.

- Production Rose, but Not Because of Rising Demand: The increase in production likely reflects backlog clearing rather than demand growth.

- Employment Weakness Signifies Real Stress: The 44.0% reading indicates layoffs, furloughs, and hiring freezes.

- Supplier Deliveries Are Faster — Not Good, But Telling: Faster deliveries indicate reduced order volumes.

Industry Performance: The Winners and Losers in November

The ISM report outlines industry performance, showing a divide between growth and contraction.

Industries That Expanded in November

- Computer & Electronic Products

- Food, Beverage & Tobacco Products

- Machinery

These sectors benefited from strong demand in defense contracts and electronics.

Industries in Contraction

Eleven industries including Transportation Equipment and Primary Metals declined, reflecting both soft consumer demand and tariff-driven costs.

What Supply Chain Executives Reported in November

1. Tariff Headwinds Are Intensifying

Tariffs on metals and components from China, Taiwan, and Europe continue to drive up costs.

2. Offshoring Considerations Are Increasing Again

Manufacturers explore options like nearshoring to Mexico or sourcing from Asia to mitigate costs and uncertainties.

3. Domestic Demand Slows

Reports indicate slow order releases and unpredictable demand, aligning with the contraction in New Orders.

4. Input Costs and Labor Costs Remain Volatile

Despite easing labor shortages, high wages still pressure margins.

Macro Implications — Why November’s PMI Matters

A PMI below 50 for nine months suggests slower GDP growth, tighter inventory management, and a shift toward resolutions in workforce strategies, highlighting:

1. Expect cautious capital spending into Q1–Q2 2026

Manufacturers might delay investments in new machines unless necessary due to contracts or aging assets.

2. Expect more focus on reshoring & automation

Automation reviews will persist despite soft demand.

3. Expect inventory normalizations

Many are reducing excess inventory from past supply chain disruptions.

What This Means for CNC Machining and Industrial Manufacturing

1. Machine Tool Demand Will Remain Uneven

Demand for aerospace, medical, and semiconductor tooling stays strong while other sectors lag.

2. More Companies Will Turn to Used CNC Machines

The used market thrives as new machine capex slows.

3. Auctions Will Increase

More plant closures will likely lead to increased equipment liquidations.

4. Labor Strategy Will Continue Tightening

Emphasis on cross-training, flexible shifts, and automation to manage workforce challenges.

Forward Outlook: What to Expect Heading into 2026

1. Manufacturing Will Stay Soft Through Winter

Ongoing contraction in New Orders indicates potential continued decline into early 2026.

2. Potential Stabilization by Spring

If rates or tariff tensions ease, demand might recover.

3. Continued Automation Growth

Despite downturns, investments in robotics and smart technology remain promising.

4. Watch These Key Indicators

- New Orders Index — crucial for assessing future movement

- Backlog of Orders — currently weak

- Customer Inventories — reported as low, potentially positive

- Tariff policy updates and interest rate decisions