Understanding the PMI Index and What to Expect Heading into 2026

Understanding the PMI Index and What to Expect Heading into 2026

The Purchasing Managers’ Index (PMI) is a crucial economic indicator that offers insights into the health of the manufacturing and services sectors. This widely-watched gauge is derived from monthly surveys of purchasing managers and serves as a leading indicator of economic activity.

What is the PMI?

A PMI reading above 50 indicates expansion in the sector, while a reading below 50 signals contraction. Its forward-looking nature allows it to provide early visibility into orders, shipments, and employment trends, making it invaluable for business leaders, investors, and policymakers.

Why the PMI matters for 2025–2026

The PMI is particularly relevant now amidst inflation concerns, supply-chain disruptions, and geopolitical risks. It helps in anticipating shifts in economic growth, which in turn aids in business planning and investment strategies. As we approach 2026, the PMI's role becomes even more critical in determining whether sectors like manufacturing and services are poised for recovery or facing continued challenges.

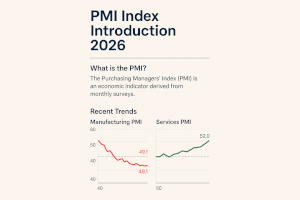

Recent PMI Trends

Manufacturing

In September 2025, the U.S. manufacturing PMI was at 49.1%, indicating a contraction. Globally, despite a rebound in mid-2025, confidence remains muted.

Services

Conversely, the U.S. services PMI showed expansion at 52% in August 2025, reflecting resilience in the services sector compared to manufacturing.

What to Watch Going into 2026: Key Predictions & Scenarios

Scenario 1: Gradual Recovery in Manufacturing

If supply-chain issues ease, the manufacturing PMI could climb into expansion territory by late 2026. Global growth forecasts suggest optimism, but risks like geopolitical tensions could offset these gains.

Scenario 2: Services Continue to Lead the Economy

With strong consumer spending and employment, services PMI may maintain its expansion, potentially advancing to the 53-55 range. However, weakened consumer demand poses a risk.

Scenario 3: Stagnation or Double-Dip Risk

Should economic pressures persist, we could see both manufacturing and services PMI hover below 50, indicating stagnated or weakening activity. External demand declines or policy tightening could exacerbate this scenario.

Implications for Business, Investors & Policy

- Businesses: A manufacturing PMI above 50 can encourage growth in production and hiring, while a below-50 reading suggests caution.

- Investors: A rising PMI signals positive prospects for equities and cyclical sectors, whereas a decline may prompt a shift to defensive assets.

- Policymakers/Central Banks: Persistent sub-50 PMIs may lead to more accommodative monetary policies, while strong PMIs could spur inflation concerns.

- Supply-chain & procurement teams: A rising manufacturing PMI indicates potential demand spikes and bottlenecks.

What to Monitor as We Move Toward 2026

- Monthly headline PMIs from major economies

- Sub-indices like new orders, employment, and inventories for early warning signs

- Inventories and backlogs data for production growth signals

- Input-price indices for inflation pressures

- Business confidence surveys

- Policy shifts affecting business activity

Final Thoughts

As we approach 2026, the PMI remains a reliable early indicator of economic trends. While the manufacturing sector faces uncertainties, the services sector's resilience provides some optimism. Businesses and investors should closely track PMI trends, as these indicators can reveal potential rebounds or cautionary signs in the economic landscape.

Would you like insights into country-specific PMI forecasts for 2026?