Tariffs Up-Front: How Trade Barriers Are Reshaping the Machine-Tool Race

Tariffs Up-Front: How Trade Barriers Are Reshaping the Machine-Tool Race

In late September, the number of workers on unpaid leave in Taiwan’s manufacturing sector exceeded 8,500, with about 30 % of them in the Taichung region. This surge of distress reflects more than domestic cost pressures — it signals how global trade policy, particularly tariffs, is pressuring Taiwan’s once strong machine‐tool cluster.

The so-called “Golden Valley” of central Taiwan finds its roll-up doors down one by one, as export-oriented machine-tool and metal-processing firms lose ground. Among the hardest hit is the local second-generation metalworker whose family factory once pulled in NT$30 million per year — now under NT$8 million.

The culprit? A convergence of structural issues. But one of the primary accelerants: tariffs and trade distortions shifting competitive advantage away from mid-size Taiwanese exporters and toward other geographies.

How Major Tariff Moves Hurt Taiwan

The U.S. “Reciprocal Tariff” Blow

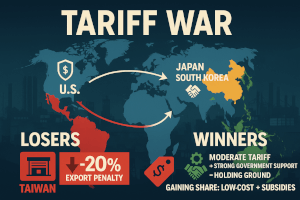

Taiwan’s machine-tool firms used to face export duties to the U.S. of around ~5 %. But starting in 2025 the U.S. introduced a new baseline “reciprocal” tariff regime. Taiwan has been treated differently (worse) than some of its regional peers:

- Taiwan’s provisional U.S. tariff on machine tools has climbed to ≈20 %, layered on top of existing Most Favoured Nation (MFN) duties — total effective duty hitting ≈ 24.7 % in some categories.

- By contrast, exports from Japan and South Korea to the U.S. face lower additional tariffs (≈15 %).

- Given the appreciation of the New Taiwan Dollar and cost increases, industry groups estimate Taiwan’s effective cost disadvantage compared with Japan/South Korea at ~20 %+.

The upshot: Taiwanese mid-tier machine-tool makers are losing export orders — particularly in price-sensitive segments — because the tariff-induced premium wipes out their usual “value for money” edge.

What Competitive Advantage Taiwan Loses

- Taiwan’s machine-tool exports have plunged over the past decade — from US$6.2 billion in 2014 to about US$2.7 billion.

- In the U.S. machine-tool import rankings, Taiwan has declined, while Japan, Germany, and South Korea maintain higher shares.

- The tariff disadvantage means U.S. buyers may shift to Japanese or Korean suppliers — who now face lower incremental duties — or to Chinese low-cost producers, squeezing Taiwan from both sides.

Tariffs + Currency + Cost Spiral

It isn’t just the duty. A strong Taiwan dollar plus rising labour, electricity, and environmental compliance costs amplify the tariff hit. For example, industry sources cite that Taiwan lost its 20-30 % price advantage over Japan due to currency appreciation and higher U.S. duty.

Who’s Gaining Ground — and Why

Japan

- Japan negotiated a bilateral trade framework with the U.S., resulting in a baseline 15 % U.S. tariff on most Japanese imports, effective August 7, 2025.

- Japan committed massive investments (≈ US$550 billion) in the U.S. as part of that deal.

- Japanese machine-tool and industrial-machinery firms can rely on relatively more favourable access to the U.S. market compared with Taiwanese firms.

- Government programs in Japan promote manufacturing upgrade, reshoring, and high-value automation.

Thus Japan is gaining relative advantage: lower tariffs + strong institutional support → more resilient export position.

South Korea

- South Korea struck a deal with the U.S. (July 2025) that lowered threatened tariffs to ≈ 15 % instead of the earlier 25 % tier, in exchange for investment commitments.

- Seoul has launched large support funds for strategic industries (≈ US$30-34 billion) to bolster competitiveness amid global trade pressure.

So South Korea receives support both in trade access and industry policy — putting it in a better competitive position.

China

- China remains a force in lower-end machine-tool production and often competes on ultra-low cost backed by government subsidies and domestic procurement policies.

- Chinese components (“red components”) are increasingly creeping into the Taiwanese supply chain — limiting Taiwan’s ability to pass on higher costs.

- Although China still lags at the high end of machine‐tool technology, it has been successful in leveraging state support and export positioning to capture lower/mid market segments.

Thus China is gaining in segments where cost matters more than precision — further squeezing Taiwan’s middle-value niche.

Government Support: Leveling the Playing Field?

Taiwan’s machinery industry is calling for support: easing labor and insurance burdens, export subsidy access, exchange-rate management.

Meanwhile, Japan and South Korea have already tied significant public policy support (investment pledges, strategic funds) to trade access deals with the U.S.

This divergence means that even where Taiwanese firms are technologically competent, the combination of higher tariffs + weaker state-backed export incentives dampens their competitiveness.

What This Means for Taiwan’s Machine-Tool SMEs

- With tariffs eroding the price edge, many Taiwanese SMEs face escalating unpaid leave, shrinking orders, and risk of closure.

- Succession problems are exacerbated: next-generation heirs see fewer prospects in a sector losing competitiveness.

- To survive, firms must shift away from “compete on cost” to “compete on value” (high‐precision, automation, niche solutions) — and lean on government support to offset tariff burden.

- Diversifying export markets (beyond the U.S.) is critical: Southeast Asia, India, Mexico are cited as alternatives.

Strategic Takeaways for the Industry & Policymakers

- Tariff disadvantage ≠ fate: but it mandates urgent transformation.

- Focus on high‐value specialization: The low‐cost manufacturing model is under threat from both China and tariff barriers.

- Leverage alliances and trade diplomacy: Taiwan needs trade-deal mitigation, preferential tariffs, or bilateral arrangements to restore access to key markets.

- Expand government export / upgrade support: Matching the level of subsidy and strategic investment seen in Japan/Korea will matter.

- Diversify supply chains & destinations: Reduce reliance on U.S. market where tariff burden is high; expand into emerging manufacturing economies.

- Currency & cost management: The strong NT $ is a disadvantage when competitors’ currencies depreciate; policy efforts to stabilize or adjust are relevant.

Conclusion

The machine-tool downturn in Taiwan is no accident — it is in large part a product of tariff policy turning from a background factor into a front-line competitive burden. Taiwanese exporters now face a triple threat: higher tariffs, rising costs, and intensified competition from Japan, Korea, and China — each backed by stronger state policy or better access.

For Taiwan’s “Golden Valley” to survive and thrive, firms and policymakers must treat tariffs not as a peripheral headache but as a core strategic risk — building export resilience, upgrading manufacturing, and fighting for equal footing in trade policy.